I wrote a previous post on how to rebuild your credit score, mentioning the fact that I had signed up for a Discover secured card to get the ball rolling. In this post, I will walk you through what a secured credit card is, the pros and cons of

getting one, and how to best use your newfound secured credit to boost your FICO score.

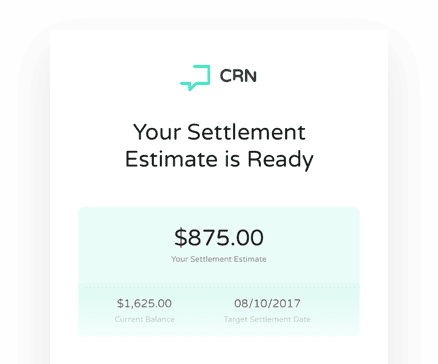

Get Your Debt Settlement Estimate

Get a debt settlement estimate and settle your debt using our platform without ever picking up the phone.

What is a secured credit card?

A secured card is a credit card that is backed with cash as collateral. In other words, if you want a $500 secured card, then you’ll have to send the bank $500 in cash to “secure” a $500 credit line. Many banks are fully secured by the deposit, but some may allow a partial deposit, meaning that your credit limit may be higher than your initial cash deposit. An example is if you sent the bank a $200 deposit, but were allowed a $500 credit line.

Benefits:

- It’s easy to get a secured credit card when you’re unable to qualify for an unsecured credit card due to poor credit worthiness.

- A secured card can act as a tool to help build or rebuild credit over a period of time, if used properly, as most banks report your payments to the major credit bureaus.

- If you default, the cash deposit you provided will be used to pay what you owe. This is also a drawback, see below.

- You could earn a few bucks through cash back bonuses on your spending, depending on what bank you choose.

- You may learn better spending habits. Keep purchases small and pay off your balance monthly.

- Deposit is refundable if you close the account or graduate to an unsecured card (some banks do this automatically), assuming you paid your bills on time.

Drawbacks:

- You have to provide a cash deposit to secure the card, which could be difficult for some people, however some banks offer secured cards with credit lines as low as $200.

- There may be application fees, ATM fees or annual fees, so be vigilant in your research, and choose a card that won’t eat up your money before you have a chance to use it.

- You can still end up in debt. If you don’t pay, the interest will pile up quickly. If you started with a $500 credit line (secured), and default, you could end up owing much more once you add in monthly interest, penalty APRs and late fees.

- Be sure your bank reports to at least one of the three major credit bureaus, otherwise it will be impossible to meet your credit building goals. And, inquire as to whether they report the card as secured or unsecured, because that can definitely make a difference on your credit report.

I Used Discover to Raise My Credit Score

I chose the Discover It Secured Credit Card to meet my particular credit goals, which was a small secured credit card ($300-$500) to help rebuild my credit and FICO score, but I could have easily gone with Capital One. It was close, but Discover won me over with the bonuses and a review at around the 6-month mark for graduation to an unsecured card.

I have had my DiscoverCard since May of 2016. I chose to deposit $500, so that was my credit limit. I’ve used it semi-monthly to pay for a nice dinner out with my husband, which usually runs about $50, give or take a few dollars, which is equivalent to about 10% of my credit limit. This is a little low, but I paid it off each month, on time for six months, and it was sufficient enough to boost my FICO score by more than 125 points!

At about the 6-month mark, Discover automatically reviewed my account and then automatically graduated my account to an unsecured credit card, unbeknownst to me, and sent me my $500 deposit back in the mail. I have to tell you, it was a fantastic surprise, being a few weeks from Christmas! That same week, Discover also sent a letter to inform me that my credit limit had been increased to $1250. Trust me, folks, this works, so let’s find you the perfect card!

You should first know what your credit needs and/or goals are before you decide which secured card to choose for yourself, but let’s compare some of the more popular ones, in no particular order.

*These are quick “snapshot” overviews. Please see the links provided (unaffiliated) for complete details on card security, features, current offers, APRs, and fees.

CREDIT UNIONS

I’m bringing up credit unions, in general, because if you’re already a member of a credit union, it might be in your best interest to inquire about a secured credit card program with them first. Many will offer much lower APR’s and little to no annual fees.

DISCOVER IT SECURED CARD – 23.24% APR

- The Good: Deposits are from $200-$2,500. Periodic account review to transition you to an unsecured card (deposit refund), no annual fee, 1% cash back on purchases (2% on gas and restaurants), free access to FICO score (TransUnion), reports to all three credit bureaus, and there’s no penalty APR. You should not be late on any payments, but the first time you are, you will not be charged a late fee. And, they have a cash back match for the first year (new customers only).

- The Bad: Late fee of up to $37, but this or the APR won’t matter if you pay off your balance monthly, on time. Discover.

CAPONE SECURED MASTERCARD – 24.99% APR

- The Good: Deposits are $49, $99, or $200 for initial credit line of $200 based on credit worthiness. Reports to all three credit bureaus, no annual fee, no penalty APR, unlimited access to credit score (CreditWise), and after 5 months of on-time payments, you can get a higher credit limit without paying an additional deposit.

- The Bad: Late fee of $35, but this or the APR won’t matter if you pay off your balance monthly, on time. At this time, CapOne does not graduate accounts to unsecured cards, but you may receive a limit increase. Capital One.

OPEN SKY SECURED CREDIT CARD -17.64% APR

- The Good: Deposits are $200-$3,000. This one tends to be more for those with really bad credit. That’s why there’s no credit check and no checking account required to make the initial deposit or qualify. They report to all three credit bureaus.

- The Bad: Annual fee of $35, and look out for “inactive late fees” after the 12-month mark. Late fee of up to $27 and penalty APR of 21.75%, but this won’t matter if you pay off your balance monthly and on time. You can’t graduate to an unsecured card because they do not offer one. Open Sky.

BANKAMERICARD SECURED VISA – 20.24% APR

- The Good: Deposits are $300-$4,900. You may be able to qualify for a higher credit limit than you deposit (partially-secured card). Free access to your FICO score, a 12-month review that may allow you to graduate to an unsecured card, and reports to the major credit bureaus.

- The Bad: Annual fee of $39. Penalty APR of up to 29.99% and late fee of up to $37, but neither will matter if you pay off your balance monthly, on time. Bank of America.

U.S. BANK SECURED VISA CARD – 19.24% APR

- The Good: Deposits are from $300-$5,000. No penalty APR, reports to all three major credit bureaus, earns interest in a savings account (minimal), and you may be able to graduate to an unsecured card after a year, but you may have to call and request it.

- The Bad: Annual fee of $29. Late payment of up to $37, but this or the APR won’t matter as long as you pay your balance off monthly, and on time. US Bank.

WELLS FARGO SECURED CARD – 19.24% APR

- The Good: Deposits are $300-$10,000. Periodic reviews for account upgrades (if upgraded, your deposit will be refunded), and reports to the major credit bureaus.

- The Bad: $25 annual fee. Late payment up to $37, but this and the APR will not effect you if you pay off your balance each month and pay on time. Wells Fargo.

Using Your Secured Card to Rebuild Credit

It’s important to remember WHY you’re doing this – for better credit. This goal can only be achieved by “playing the game”. The game is a small set of credit rules that insure a positive outcome. The bank gets what they want (money) and you get what you want – a better credit rating.

Rule #1 – Pay on time, every time (set reminders).

Rule #2 – Pay your balance in full every month (auto-pay may be an option).

Rule #3 – Keep credit utilization low, ideally 15-30% of your total secured credit line.

Rule #4 – Use the card frequently, but for small purchases only.

Rule #5 – DO NOT CARRY A BALANCE – EVER (to avoid interest and late fees).

If you’ve had any experience with any of the above-mentioned cards, have questions or tips to help others on their quest to improve their credit, please share below in the comment section.

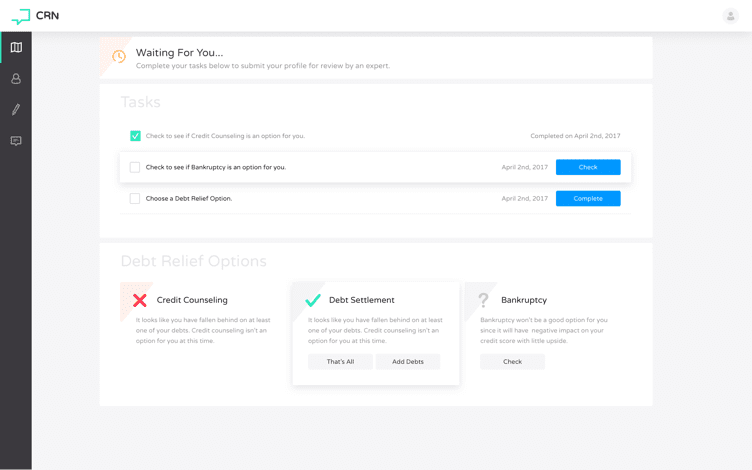

Get a Settlement Estimate

If you’ve fallen behind on your payments, then we can help you settle your debts with your creditor directly through our platform.

Get EstimateGet a Free Consultation

Getting out of debt is confusing. Signup today to get a free debt consultation and we’ll show you your best path out of debt and help you get there.

Get StartedHave a Quick Question?

We have experts standing by to answer any questions you have about debt settlements, lawsuits and judgements.

Ask a Question